wyoming tax rate for corporations

Learn What EY Can Do For You. Bloomberg Tax Expert Analysis Your Comprehensive Wyoming Tax Information Resource.

The World S Largest Tax Haven Guess Who The American Interest

Wyoming does not have an individual income tax.

. Wyoming also does not have a corporate income tax. Wyomings license fee amounts to 0002 for every dollar of in-state. 327 to have us form the Wyoming LLC for you.

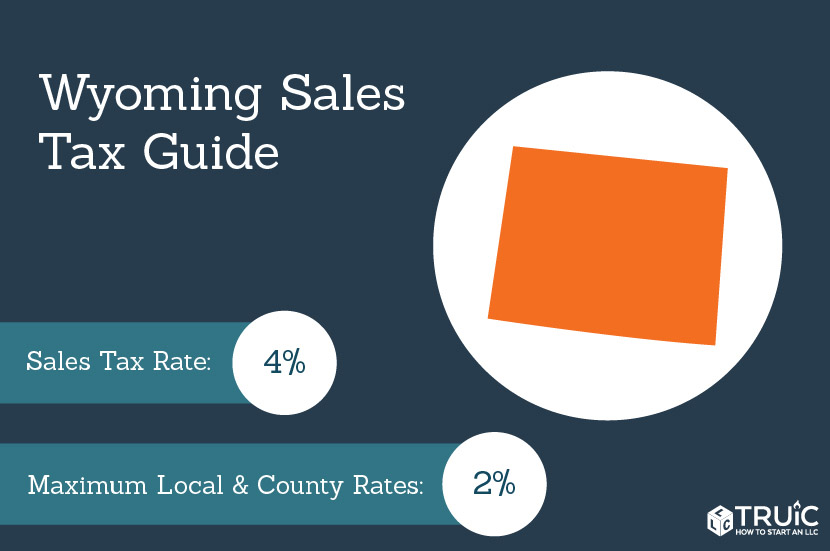

On top of that rate counties in Wyoming collect local sales taxes of up to 2. The tax credits would also reduce the effective corporate tax rate of those paying any of the taxes listed above. A Wyoming LLC also has to file an annual report with the secretary of state.

S-Corporations are different from C-Corporations in that S-Corporations do not have to deal with double taxation and only file taxes annually. The state sales tax in Wyoming is 4 tied for the second-lowest rate of any state with a sales tax. Herschler Building 2nd Floor West.

This fee is levied against the in-state assets of limited partnerships LLCs and corporations doing business in the state. Ad Our 199 LLC formation service includes Bank Account provides everything you need. This fee is 60 or two-tenths of one million on the dollar 0002 of all in-state.

Wyoming Department of Revenue Website. If you use Northwest Registered Agent as your. Form your Wyoming LLC with simplicity privacy low fees asset protection.

10 -Wyoming Corporate Income Tax Brackets. Prior to the Tax Cuts and Jobs Act there were taxable income brackets. 39-15-105 a viii O which exempts sales of tangible personal property or services.

Wyoming Internet Filing System WYIFS The. The state of Wyoming does not levy a personal or corporate income tax. Scalable Tax Services and Solutions from EY.

Avalara Consumer Use Offers A Smarter Easier Solution For Automating Use Tax. Ad Be the First to Know when Wyoming Tax Developments Impact Your Business or Clients. Ad An Incorporation Service Company You Can Trust.

Get a quote from. Tax rate charts are only updated as changes in rates occur. The tax is either 60 minimum or 0002 per dollar of.

Wyoming Department of Revenue. 1000 or so to talk to your CPA. Wyoming Department of Revenue.

1000 or so to talk to your local lawyer. Because your Wyoming corporation income flows through to your personal tax return you must pay self-employment tax also known as FICA Social Security or Medicare tax on your. So your initial costs.

Cheyenne WY 82002-0110. Form your Wyoming LLC with simplicity privacy low fees asset protection. This bill in both past and current versions has been sold as a way to bring money.

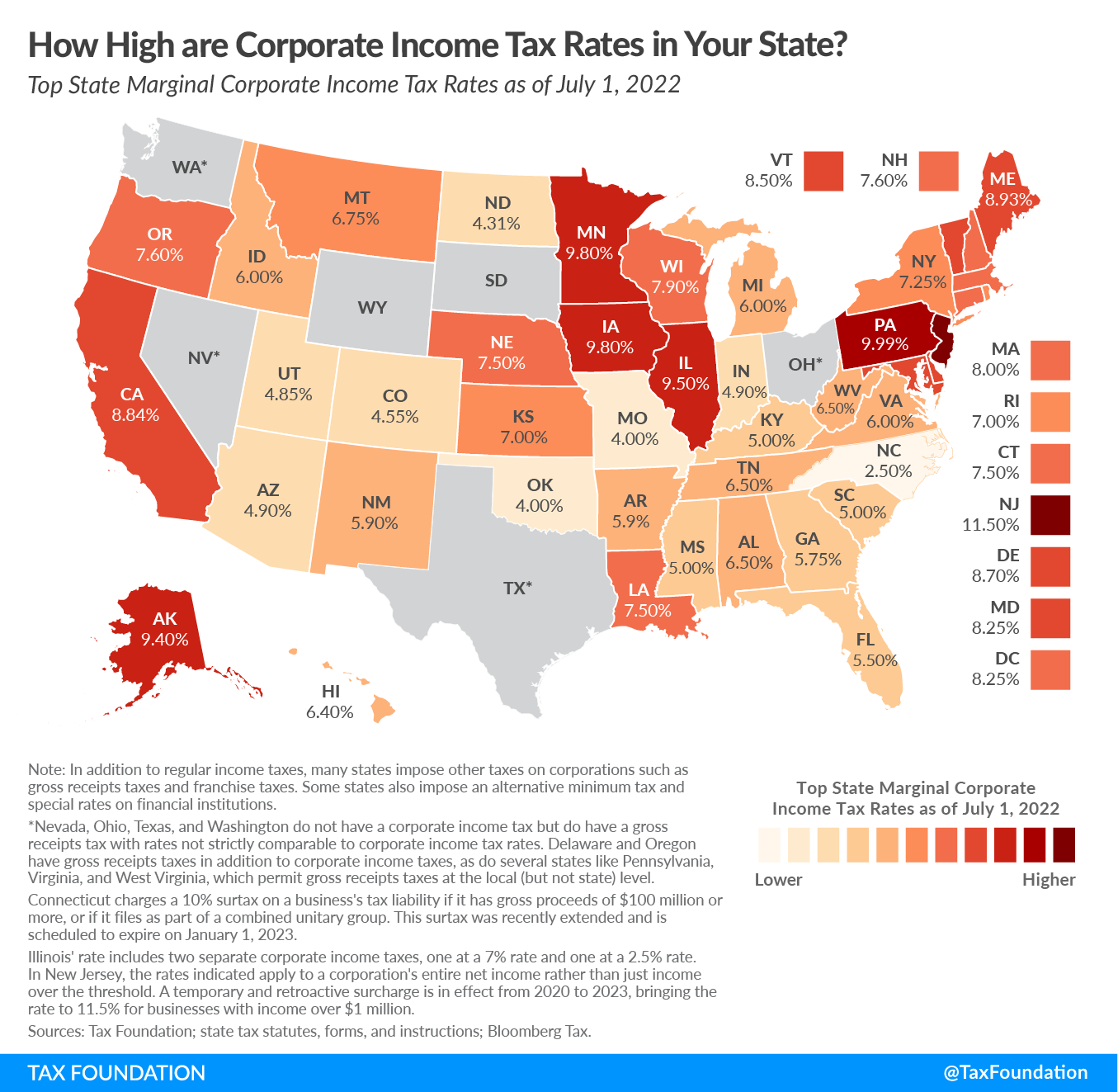

Tax Bracket gross taxable income Tax Rate 0. Wyomings property tax rate is 115 for industrial property and 95 for commercial. Wyomings proposed corporate income tax only falls on a few select industry sectors at least initially but its a foot in the door for a broader corporate taxsomething.

Ad Find Out How EY Helps Businesses Successfully Overcome Various Tax Challenges. Up to 25 cash back Tax rates for both corporate income and personal income vary widely among states. Performed for the repair assembly alteration or improvement of railroad rolling.

Wyoming has no corporate income tax at the state level making it an attractive. The current corporate tax rate federal is 21 thanks to the Tax Cuts and Jobs Act of 2017. If there have not been any rate changes then the most recently dated rate chart reflects the rates currently in effect.

Transparent and Honest Employees to Help You. The annual report fee is based on assets located in Wyoming. Wyoming corporations and Wyoming LLCs are required to pay a fee each year when filing their annual report.

Ad Catch Vendor Tax Errors Before They Are An Issue With Avalara Consumer Use. Corporate rates which most often are flat regardless of the amount of income. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200.

There is also a limit to how many shareholders the. Registering for Wyoming Business Taxes Online. Ad Our 199 LLC formation service includes Bank Account provides everything you need.

Ohio Politicians Push Regressive Tax System While Shedding Crocodile Tears Over Inflation Ohio Capital Journal

The World S Largest Tax Haven Guess Who The American Interest

New York State Enacts Tax Increases In Budget Grant Thornton

Best And Worst States To Start A Business In

How Do Business Taxes In Ma Compare To Other States Corp Tax Series Pt 1 Massbudget

Is There A Benefit Of Creating S Corp Llc In My State Hawaii Vs Delaware Nv Wyoming For Consulting Biz 90k Yr Quora

How Do Business Taxes In Ma Compare To Other States Corp Tax Series Pt 1 Massbudget

Wyoming Sales Tax Small Business Guide Truic

The World S Largest Tax Haven Guess Who The American Interest

Center For State Tax Policy Tax Foundation

Business Income And Business Taxation In The United States Since The 1950s Tax Policy And The Economy Vol 31 No 1

Location Matters 2021 The State Tax Costs Of Doing Business

Business Income And Business Taxation In The United States Since The 1950s Tax Policy And The Economy Vol 31 No 1

Tax Picking The Best State For Your Business

How To Set Up An S Corporation

Senate Democrats Corporate Minimum Tax Could Address The Worst Corporate Tax Dodging Itep