portability of estate tax exemption 2020

The estate tax exemption dates back to the Revenue Act of 1916 when the federal government started taxing estates valued at over 50000. We will mail checks to qualified applicants.

How To Advise Your Clients Under The New Estate Tax Law Ppt Download

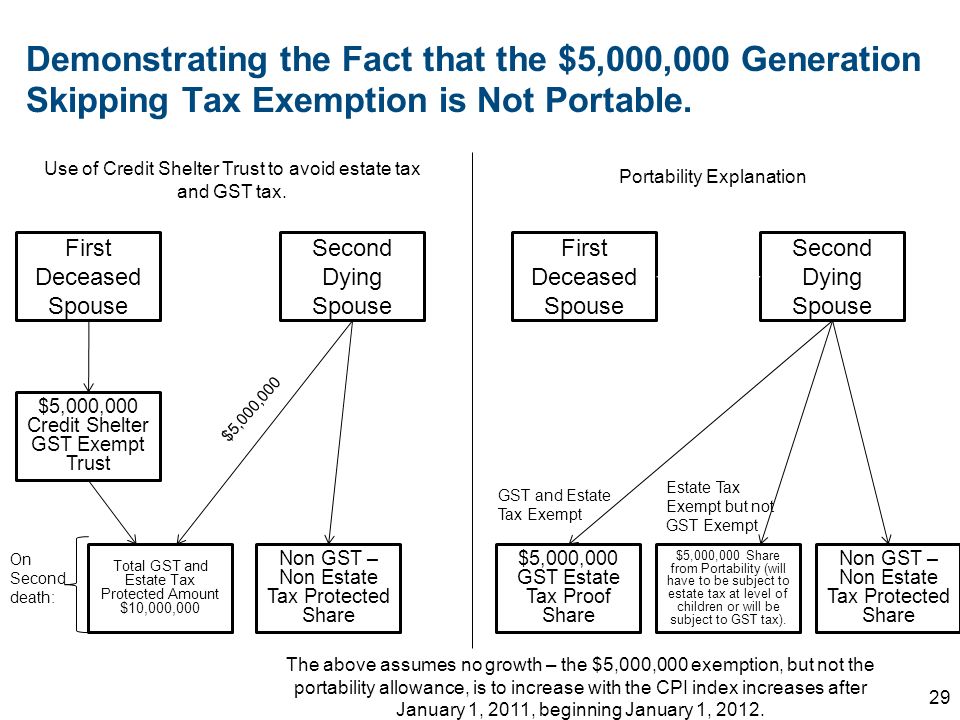

The portability of a deceased spouses unused estate tax exemption is an important concept and is even more so in 2020 which is a pivotal year in so.

. This set the stage for greater. Portability Of Estate Tax Exemption 2020. You are eligible for a property tax deduction or a property tax credit only if.

Once exemption levels fall. The Illinois estate tax on an estate of 16880000 would be 1524400. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey.

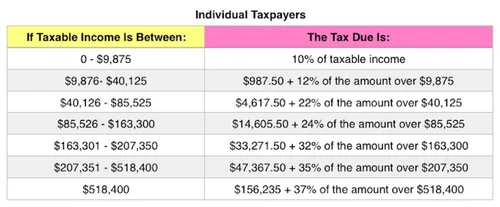

The landmark Taxpayer Relief Act of 1997 called for a gradual increase in the estate exemption from 600000 in 1997 to 1 million by 2006. 11400000 in 2019 11580000 in 2020 11700000 in 2021 and 12060000 in 2022. Portability Of Estate Tax Exemption 2020.

What is the estate tax exemption in 2020. If a tax return was filed for the estate and portability was elected the estate of the survivor will have the applicable exemption amount from the year of death and the 1206. The move that protects everyday millionaires from the estate tax hit in 2026.

Get information on how the estate tax may apply to your taxable estate at your death. A qualifying estate is one in which i the decedent is survived by a spouse ii the decedents date of death was after december. This exemption stayed in.

ANCHOR payments will be paid in the form of a direct deposit or check not as credits to property tax bills. The 2020 increases to the estate tax exemption also impact the portability of the exclusion from a deceased spouse to their surviving spouse. A qualifying estate is one in which i the decedent is survived by a spouse ii the decedents date of death was after december.

The portability of a deceased spouses unused estate tax exemption is an important concept and is even more so in 2020 which is a pivotal year in so. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. When Mark dies in 2020 he is able to take advantage of the estate portability rules which means he gets the federal tax exemption that Joan didnt use 114 million plus.

This Act amends the basic exclusion to 1158 million US for 2020. We are currently mailing ANCHOR benefit information mailers to. If your total worldwide estate in 2020 is less than 1158 million.

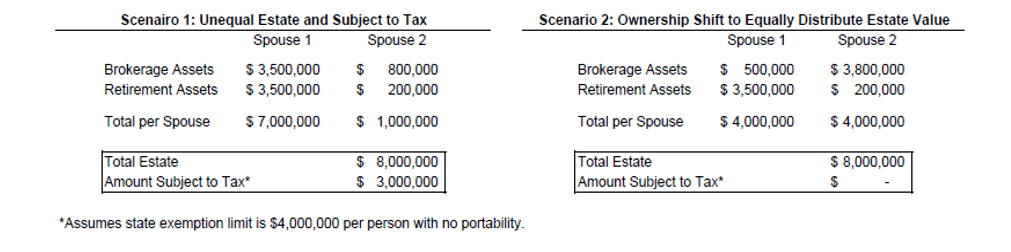

To 20 million file an estate tax return and elect portability. The option of estate tax exemption portability can make a significant difference when it comes to taxation of an estate. Therefore the objective should be to get the survivors estate at or below the 4000000.

Final Regulations Confirm No Estate Tax Clawback Center For Agricultural Law And Taxation

Portability Of The Estate Tax Exemption Cdh Law Pllc

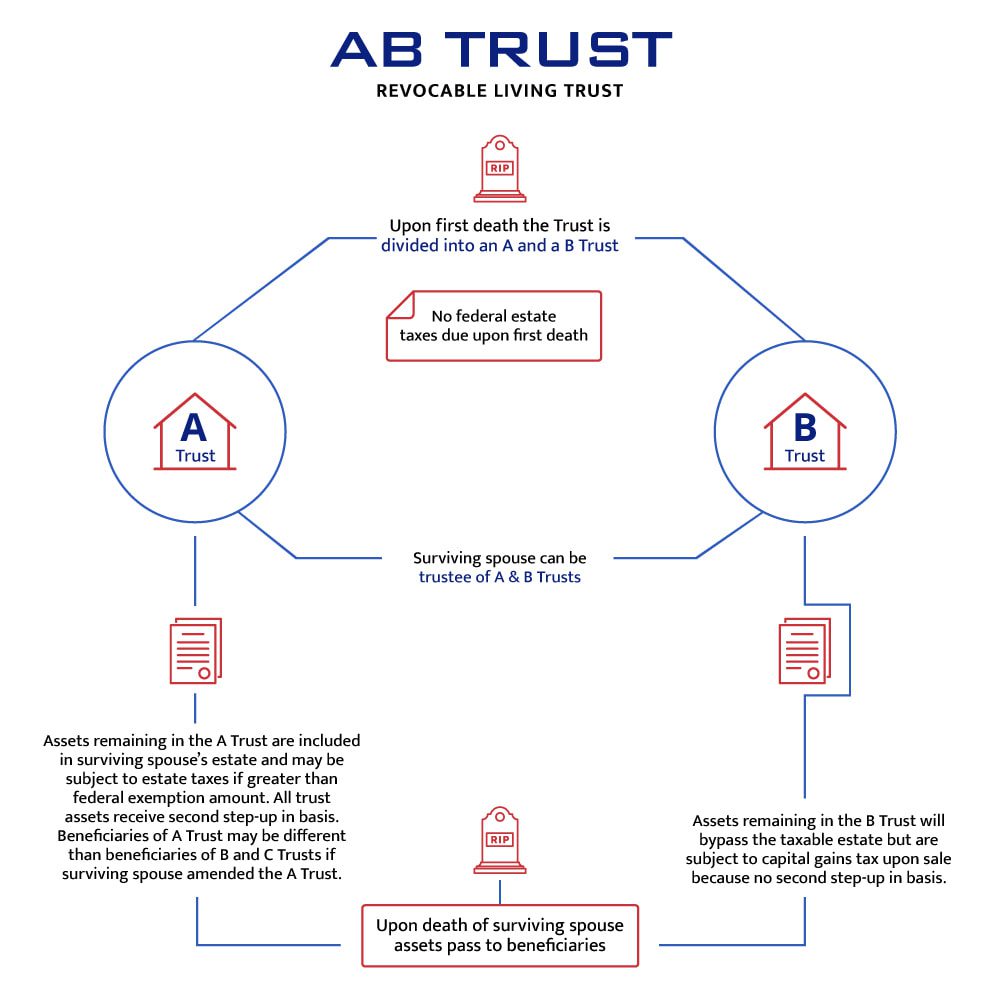

To A B Or Not To A B That Is The Question Botti Morison

Estate Tax Current Law 2026 Biden Tax Proposal

Seltzer Caplan Mcmahon Vitek San Diego Law Firm

Irs Increases 2020 Estate Tax Exemption Postic Bates P C

Tax Related Estate Planning Lee Kiefer Park

Minimize Your State Estate Taxes Through Proper Planning C W O Conner Wealth Advisors Inc Atlanta Georgia

Portability Of A Spouse S Unused Exemption 1919ic

Portability Of The Estate Tax Exemption Drobny Law Offices Inc

2020 New York Resident Estate Taxation Parisi Coan Saccocio Pllc

Limiting Your Minnesota Estate Tax Liability Bgm Cpas Estate Taxes

Estate Tax In The United States Wikipedia

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

What Surviving Spouses Need To Know About The Marital Portability Election Natural Bridges Financial Advisors

Irs Announces Higher Estate And Gift Tax Limits For 2020 Senior Law

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm